how are property taxes calculated in broward county florida

Broward County 2022 Tax Bills will be mailed on November 1st. Tax Payments All property taxes become due November 1st must be paid no later than March 31st and become delinquent if not paid before April 1st Discounts are applied to.

County Tax Auctions Put Small Investors At Disadvantage Sun Sentinel

Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the.

. The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. Lands Available for Taxes LAFT Latest Tax Deed Sale Information. Broward County Florida calculates property taxes simply by taking a percentage of the propertys value.

NOT part of our office mails the annual property tax bills during the first week of November. Awarded authority by the state district governments administer property taxation. Calculation for Deed Doc Stamps or Home Sale Price.

The BROWARD COUNTY TAX COLLECTOR note. The estimated tax amount using this calculator is based upon the average. Payment information is include with the.

Florida Property Tax Rates. The amount of property taxes you owe in Broward County is determined by two things. Typically they are paid on a yearly or monthly basis.

This tax estimator is based on the average millage rate of all Broward municipalities. The assessed value of the property and the tax rate. How Does Broward County Real Estate Tax Work.

For example a property with an assessed value of 50000 located in a municipality. Estimate My Broward County Property Tax. 2nd Installment payable by September 30.

Broward County collects on average 108 of a propertys. Broward County 2022 Tax Bills. Most often taxing municipalities tax levies are.

Just Value - Assessment Limits Assessed Value Assessed Value - Exemptions Taxable Value Taxable Value X. If you would like to. Recording Fee Documentary Tax Calculator.

Based on that rate and Broward Countys median home value of 247500 you can expect to pay an average of 2664 a year in property taxes in Broward County. To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. The Broward County Property Appraisers.

1st Installment payable by June 30. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. Usually property taxes are not.

Any deadline extension granted by the Governor in reference to Hurricane Ian is. This simple equation illustrates how to calculate your property taxes. Calculation for Recording Fee.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. Property taxes in Florida are implemented in millage rates. ¼ of the previous years taxes discounted 45.

¼ of the previous years taxes discounted 6. Fire or Going Out Of Business Sale Permits.

Home Seller S Net Proceeds Calculator Broward County Fl

Broward County Property Taxes What You May Not Know

Property Taxes Polk County Tax Collector

Florida Property Tax H R Block

Property Tax Appeal Experts Broward Miami Dade Palm Beach Tax Appeal Services

Are Big Property Value Increases Going To Mean Big Tax Increases

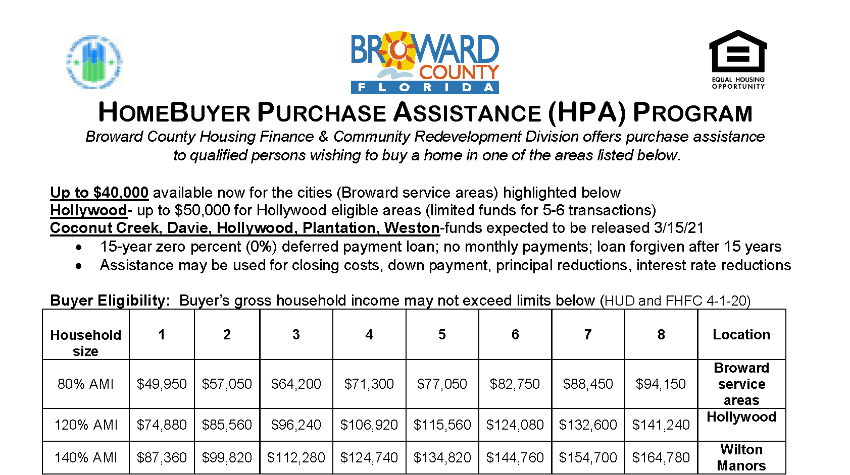

Broward County Resources Housing Foundation Of America

2022 Municipal Taxes Will Be Lower Than Anticipated Explains Coral Springs City Manager Coral Springs Talk

Finding The Right Schools In Broward County Fl By The Sea Realty

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

It S Becoming Unaffordable Broward Property Taxes Skyrocketing Cbs Miami

Broward County Fl Property Tax Search And Records Propertyshark

Florida Property Tax Calculator Smartasset

How Rising Property Values Could Impact Your Property Tax Bill Nbc 6 South Florida

Marty Kiar Broward County Property Appraiser

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

How To Look Up Property Taxes In Broward County Florida Tutorial Youtube

Will Inflation Increase Property Taxes This Year In Florida Miami Herald